Photo courtesy: US Navy

By Mass Communication Specialist 2nd Class Michael Russell | US Navy

.............................................................................................................................................................................................

While at Base Hospital Mutur, Sailors and Marines repaired broken bathroom sinks and toilets and examined the water purification system, according to Hull Technician 1st Class Taylor Edberg, a community relations volunteer.

"We ripped up every plumbing fixture in the space," said Edberg. "The sink, the toilet and all of the plumbing lines associated with it. To help the local people was a great experience."

Edberg also said the bathroom in the hospital waiting room had no working plumbing fixtures, but Pearl Harbor Sailors replaced these with new fixtures.

Pearl Harbor Sailors spent off duty hours with local Sri Lankan Navy personnel, sharing experiences and cultures. Sailors and Marines from both countries traded belt buckles to keep as souvenirs.

Lt. Andrew Haylor, the 15th Marine Expeditionary Unit chaplain, organized the event and said the community relations project was a successful event for U.S. Navy Sailors and the Sri Lankan community.

"At the end of the day, I feel the mission was a great success," said Haylor. "I think what we did was very helpful. There was a lot of good engagement with the local community, as well as the Sri Lankan Navy."

Pearl Harbor is part of the Peleliu Amphibious Ready Group (PEL ARG). Other elements of the PEL ARG include Commander, Amphibious Squadron 3; USS Peleliu (LHA 5); USS Dubuque (LPD 8); Fleet Surgical Team 1; Tactical Air Control Squadron 11; Helicopter Sea Combat Squadron 23, Detachment 5; Assault Craft Unit 1, Detachment F; Assault Craft Unit 5, Detachment B; and Beachmaster Unit 1, Detachment D.

The PEL ARG is transiting the 7th Fleet area of responsibility and reports to Commander, Amphibious Force 7th Fleet, Rear Adm. Richard Landolt, who is headquartered in Okinawa, Japan.

© www.navy.mil

Saturday, July 17, 2010

USS Pearl Harbor sailors, marines participate in Sri Lankan Community Relations Project (COMREL)

Saturday, July 17, 2010

CID grills 'Lanka' staff

Daily Mirror

.............................................................................................................................................................................................

According to the newspaper CID officers arrived at the head office of 'Lanka Irida' Sunday newspaper last evening and obtained a statement regarding a news article published on the 'Lanka Irida' newspaper a few days ago.

The CID officers also collected personal information of the employees working in the office, the newspaper added.

© Daily Mirror

Saturday, July 17, 2010

U.N. official to return to Sri Lanka after spat

By Patrick Worsnip & Chris Wilson | Reuters

.............................................................................................................................................................................................

Neil Buhne "will conclude his visit to New York this week and he will return to Colombo," U.N. spokesman Farhan Haq told reporters.

Secretary-General Ban Ki-moon recalled Buhne last week and ordered the closure of a U.N. regional center in Colombo during protests against a U.N. war crimes panel.

The United Nations said the protests hampered its ability to operate.

The demonstrations were led by Sri Lankan Construction Minister Wimal Weerawansa, who declared a hunger strike. Last Saturday, President Mahinda Rajapaksa ordered Weerawansa to end the fast.

The protests followed Ban's appointment of a three-member panel to advise him on "accountability issues" stemming from the Sri Lankan government's destruction last year of Tamil Tiger separatists, ending a 25-year war. Human rights groups have criticized civilian deaths in the war's final phase.

"It is important to continue U.N. efforts to assist the people of Sri Lanka, particularly with regard to reconstruction and rehabilitation in the (mainly Tamil) north," Haq said.

Buhne would convey to Sri Lankan leaders "the secretary-general's strong expectations for better treatment of the U.N. family in Sri Lanka," he said, as well as progress on resettlement of refugees, reconciliation and accountability.

© Reuters

Saturday, July 17, 2010

Sri Lankan central banker writes pro-poor book

Lanka Business Online

.............................................................................................................................................................................................

"Money does not raise economic growth, but it is the fundamental cause of high rate of inflation that is detrimental to economic growth," H N Thenuwara, a former assistant governor of Sri Lanka's central bank says frankly in a newly released book.

"High inflation and low economic growth jointly account for the poverty of nations."

Many so-called 'third world' states which restricted the economic freedoms of their citizens and kept growth down also appropriated their wealth stealthily through an 'inflation' tax slashing the real value of people's salaries and lowering their living standards.

High inflation is usually created by using central bank credit (printed money) to finance budget deficits, by governments that do not collect enough revenue to finance its expenditures and also does not want to borrow at market rates.

Though increasing economic freedoms of people and reducing state controls (open economies and liberalization) can create real jobs, even the employed will remain poor in such countries if inflation is high and the exchange rate falls constantly.

By imposing draconian exchange controls a money printing central bank can also block citizens from protecting their property rights by shifting their savings into a stronger currency, again destroying real wealth.

South Asian Central Banks

The tool came from central banks which have the power to inflate without limit by increasing the money supply and depreciating the currency.

"Central Banks in South Asia were established as symbols of political independence," says Thenuwara in his book Money Inflation and Output, which pulls no punches or tries to cover up central bank mistakes in any country.

An exception to the rule was the Reserve Bank of India, which was established as a private corporation before independence from Britain.

LBO's economics columnist fuss-budget says India had a rich tradition in good money, both in the form of gold and silver. Its rupee was used widely in Africa and the Middle East as do 'dollarized' nations today by using the dollar, sterling or euro as their currency.

Sri Lanka's currency board also had the Indian rupee as the anchor currency for most of its life.

Fuss-budget says the Indian rupee started to lose its value after RBI was nationalized and made into a state entity following independence from British rule due to excessive money printing.

Middle Eastern countries, ranging from Kuwait, to Abu Dhabi, to Qatar soon dumped the Indian rupee and adopted Saudi currency or created their own.

The UK pound also lost value after the Bank of England was nationalized as a suspicious public that kept its excesses under check as a private corporation was lulled into a state of complacency under state ownership.

Thenuwara's book points out that a private central bank was abolished by an angry public in the United States, a country that had history of gold as money and free banking.

Sustained large scale inflation started in the US only after the establishment of the Federal Reserve, a semi-state institution in 1916.

India's rupee started to appreciate only after policies changed in 1991 following a severe balance of payments crisis and its Treasury secretary was no longer sitting in on monetary policy meetings.

Sri Lanka's central bank is also now starting to pursue low inflation policies with its current governor firmly committed to stability, though concerns remain about its ability to stay on the straight and the narrow given fiscal pressures..

Currency Board

Sri Lanka started a pegged exchange rate central bank in 1950 abolishing a currency board arrangement that kept the exchange rate stable from the previous century under British rule.

A currency board targets only the exchange rate and does not print money to manipulate interest rates, thereby eliminating foreign currency shortages or currency depreciation, giving a stable money to the people, provided the anchor central bank was keeping good policy.

"If there is a foreign currency outflow, the currency board has to absorb domestic currency from its economy which reduces the domestic money supply," writes Thenuwara.

"A central bank on the other hand, does not obey the rules followed by currency boards."

Thenuwara says countries that kept currency boards or re-established them including Brunei and Hong Kong in Asia have had low inflation and high growth.

Estonia and Lithuania have had very high rates of inflation prior to establishing currency board like systems after the end of the Soviet Union and a collapsing ruble.

"Their success is seen in the low interest rates seen since the 2000."

Soft Pegs

Sri Lanka's pegged exchange rate system was devised by John Exter, a US Federal Reserve official.

The bank which was designed to keep a peg with the US dollar and print money at the same time, targeted both the exchange rate and the interest rates in a policy contradiction an arrangement.

Some economists call the arrangement a soft peg as opposed to a 'hard pegged' currency board.

The US exported the model first to Latin America where it wreaked havoc and created massive inflation and wealth disparities by enriching landowners and real asset owners who were protected against inflation.

The model was exported to the rest of the world under the Bretton Woods system. In the early 1970s most of the so-called developed world exited soft pegs and became true floaters.

True floaters though not vulnerable to 'balance of payments crises' that comes from peg defence, can still be vulnerable to economic bubbles and bank runs when the bubble collapses as happened after 2007.

"In developed countries, crises have been caused by productivity slowdown, and insufficient attention paid to the formation of asset price bubbles," writes Thenuwara candidly.

"In developing countries, crises are driven by populist policies of governments, expansionary fiscal policies, and the pursuits of fixed exchange rate regimes by monetary authorities.

"In all countries, the monetary authority has always been either a part of the cause of the crisis or the part of the solution to the crisis."

© Lanka Business Online

Saturday, July 17, 2010

India bags contract to build rail line,communication system in Sri Lanka

The Economic Times

.............................................................................................................................................................................................

The contract for reconstruction of Northern Railway Line and telecommunication system has been awarded to Indian Railway Construction International Ltd or IRCON at a total amount of $ 86.5 mn, an official statement said.

The northern railway line was destroyed during the decades-long ethnic conflict in the island nation which ended last year in May with the defeat of the LTTE.

The Sri Lankan government has also decided to ink a contract with China National Machinery Import and Export Corp (CM)l to develop the Matara-Beliatta railway line at a cost of USD 290 million.

The contract will also include signalling, telecommunication and ticketing systems and the maintenance of these systems.

It was not immediately known when the projects would be completed.

Talks are also underway for IRCON to construct the line from Omanthai to Pallai while the Peoples Republic of China is proposed to be awarded the contract for construction of the rail line from Pallai to Kankesanthurai in Jaffna peninsula.

© The Economic Times

This site is best viewed with firefox

Search

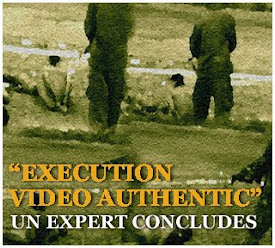

Is this evidence of 'war crimes' in Sri Lanka?

Archive

- ▼ 2010 (1312)

- ► 2011 (687)

Links

- Reporters Sans Frontières

- Media Legal Defence Initiative

- International Press Institute

- International News Safety Institute

- International Media Support

- International Freedom of Expression eXchange

- International Federation of Journalists

- Committee to Protect Journalists

- Asian Human Rights Commission

- Amnesty International